NVIDIA's net profit soars by 628%! Is it peaking?

On the early morning of May 23rd Beijing time, NVIDIA Corporation announced its financial report for the first quarter of the new fiscal year. The results of the report were astonishing; its revenue grew by over 260%, and its profit increased by more than 620%. At the same time, its profit margin reached over 78%, which is an incredibly high rate.

This news caused a significant surge in its stock market value, with the market capitalization reaching a level of 2.3 trillion. This is another company with a market value of over 200 billion.

I immediately saw a flurry of comments emerging, and everyone was not calm. Some said, look, NVIDIA's market value is equal to Intel plus AMD, plus TSMC, plus Qualcomm, plus a bunch of other chip companies, seemingly one company is larger than all other chip companies combined. Others even said that NVIDIA alone is carrying the American economy.

Of course, many people immediately began to doubt, saying that no matter how good NVIDIA's performance is, can it maintain this market value? We say not only can it maintain it, but there is also room for growth. Why do we say that?

Advertisement

Because historically, many technology companies have a flywheel effect. What does this mean? It means that the more they accumulate, the faster they develop later on, and when they seem big, they actually develop faster.

There are plenty of such examples, it's just that people are a bit forgetful. For instance, the world's first company to exceed a market value of one trillion, Apple, reached a trillion in 2018, but in just two years by 2020, it reached two trillion, and then by 2023, it reached three trillion.

Similarly, Microsoft reached a market value of one trillion in 2019, and two trillion in 2021. Now, Microsoft's market value has even surpassed Apple, with a little over three trillion. So you see, in just a few years, even a trillion-dollar entity can triple. So why must we doubt that NVIDIA's market value has reached 2.3 trillion and must it fall?

We say that there is clear evidence that it will continue to rise. Why do we say that? We will explain from both macro and micro perspectives.

Let's start with the micro perspective. Looking at NVIDIA's financial statements, its main source of income is cloud computing, especially those few giant platform companies in cloud computing, which account for nearly half of its market share in cloud computing.

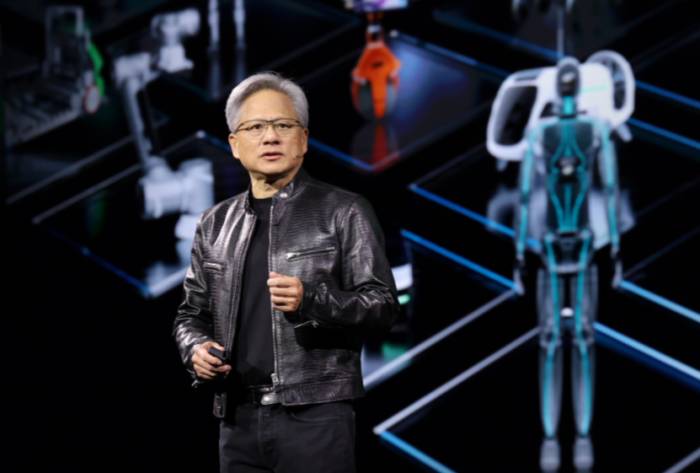

I can tell you that the investment in cloud computing will continue, and the scale will expand. Why is that? Because these cloud computing platforms have been competing in text-to-text and text-to-image, and now they are also competing in text-to-video, and the competition behind this is still fierce.Moreover, Jensen Huang is particularly adept at strategic planning, having laid out the groundwork for the next explosive growth area, which is autonomous driving. Note that we say that pure vision-based autonomous driving is gradually becoming mainstream; in fact, autonomous driving can also be seen as just one example of visual intelligence. This field will also require a significant amount of computing power to support it, which will undoubtedly fall into NVIDIA's hands.

That is to say, when you look at the specific micro-markets, the demand is very strong. But speaking from a macro perspective, there are even greater opportunities waiting for everyone. Why do we say that?

This round of artificial intelligence is essentially a general-purpose technology, which has appeared many times in the history of human development. The earliest steam engine was a general-purpose technology because it could be used in various fields. Later on, this included assembly lines, transportation, containers, and even PCs, the internet, and wireless internet.

When general-purpose technologies emerge, they trigger a new round of rapid industrial growth. At the beginning of this rapid growth, the pioneers often reap the greatest benefits. We are witnessing the rapid growth of this round of artificial intelligence unfolding in wave after wave, and the most important pioneer, of course, is NVIDIA, because computing power must take the lead.

So, where do we see the next round of opportunities? Besides the cloud computing and autonomous driving we just mentioned, we believe that a more significant trend is terminal intelligence, with the intelligence of smartphones rapidly increasing.

Many people might say that the intelligence of smartphones is increasing, but they may not use GPUs. That's true, but the rapid increase in smartphone intelligence will lead to a large number of individual users adopting intelligent services and businesses. The computing power provided by terminal intelligence might be a small part, with a larger portion being provided in the cloud. This means what? When every smartphone user truly utilizes artificial intelligence, the demand for cloud services and NVIDIA will skyrocket.

Speaking of this, you understand that looking at financial statements, the company's absolute market value, and evaluating its future development is not advisable. Why? Because we say that finance is a lagging indicator, and Huang himself has spoken about the "Early Indicator of Future Success," which is a precursor to future success.

Huang's ability to have such a philosophy and apply it to the company's operations allows him to lay out the groundwork for this round of technology. NVIDIA is undoubtedly a driver and, of course, the biggest beneficiary. Its room for growth is not seen from a financial capital perspective but from an industrial perspective, which is still very broad.

I say it has the potential to reach a market cap of $3 trillion or $4 trillion in the next two to three years, or even three to five years, which is conceivable, so don't be too surprised.

At such times, what everyone should be concerned about is not how much NVIDIA will rise in the future, but what the rise of NVIDIA implies behind the scenes.In fact, it signifies that the broad trend of artificial intelligence as a general-purpose technology has finally arrived and will permeate into thousands of households. So what should you be thinking about now? It's how you can leverage this technological trend to drive social development.

The development of technology has such characteristics: it starts from the basic platform and then moves to the application layer. Generally speaking, the opportunities that can be generated at the application layer are much greater than those below, and in fact, it forms an inverted pyramid structure. The real future giants will be nurtured from the application layer.

Don't focus on how much NVIDIA's market value is today. The companies with truly huge market values in the future may be today's application companies, and those are the ones truly worth our attention, and even more so, those are the ones you should be positioning yourself in.

Because if you position yourself correctly, as Huang Renxun said, being able to find the Early Indicator of Future Success, finding the advanced indicators of future success, you might just be the future success story.

Leave A Comment